Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX. Another example is the payment of your BAS after you have lodged it to the ATO.

You can zero-rate your supply of services ie.

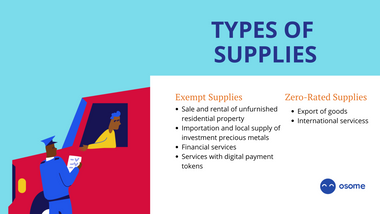

. In Malaysia GST largely falls under 4 different categories. It is now refers to Total Value of Other Supplies that comprises of tax codes. In addition the provision of services by the Government is also out of scope.

Overview of Goods and Services Tax GST in Malaysia. Exempt and out of scope supplies are not taxable supplies. Company A has imported goods from overseas and stored them in the FTZ.

SCOPE OF TAX 3. Jabatan Kastam Diraja Malaysia. The Service tax is also a single-stage tax with a rate of 6.

Here is the a potential list of out of scope supplies to be disclosed. For example if you had two different bank accounts and you transferred money between them they would be classified as Out of Scope. Tax Code Mapping to GST-03 Box 15.

Hi user61842 When it comes to Out of Scope these transactions are not subject to GST nor are they to be reflected on your BAS. Here is A List of Potential Out of Scope Supplies. For more information regarding the change and guide please refer to.

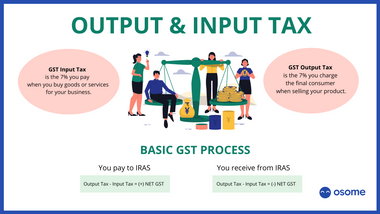

GST should be accountable at standard rate 6 on the value of supply up to 31 May 2018. GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones.

A specific Sales Tax rate eg. July 23 2021 700 AM. Goods services that fall under each of these categories are pre-determined by the RCDM Royal Custom Department of Malaysia.

Company A then sells the goods to Company B which received the goods within the FTZ. No GST will be imposed on the supply made by the Federal Government and State Government such as healthcare services provided by hospital and. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

This preview shows page 23 - 25 out of 39 pagespreview shows page 23 - 25 out of 39 pages. Organizations prepare for GST implementation in Malaysia. OS OS-TXM GS NTX and SR-JWS.

Supplies not within the scope of GST Supplies which do not fall within the charging provision of the GST legislation include non-business transactions sales of goods from a place outside Malaysia to another place outside Malaysia employment income and penalties. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. It is important to note that not all services provided to overseas customers can be zero-rated.

The Royal Malaysian Customs Department RMCD has already commenced GST closure audits even arranging for tax professionals to conduct some audits for and on their behalf. It has been reported that businesses in Malaysia have spent almost RM15 billion to implement GST systems that have been in use for less than four years8. With a target to close all GST audit-related activity by the end of 2019 its unlikely that all 480000 GST registrants will be audited.

As such the rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards. A taxable supply is a supply which is standard rated or zero rated. In the service tax no input exemption mechanism is.

Besides the General Guide on GST industry guides are also made available specifically to provide guidance to businesses and organizations operating in specific industries. The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018. However it may change from time to time.

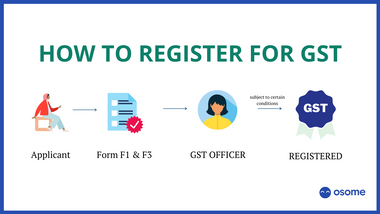

An expert in taxation has recommended that the goods and services tax GST be re-introduced only after the scope of the sales and services tax SST has been. Charge GST at 0 only if it falls within the description of international services under Section 21 3 of the GST Act. Download form and document related to RMCD.

GST code Rate Description. GST Tax Codes for Supplies. 030 Malaysian ringgits MYR per litre is applicable.

Malaysia GST Reduced to Zero. These are standard-rated supplies exempt supplies zero-rated supplies and supplies that are beyond the scope of Goods Services Tax. From 01 June 2018 GST should be charged at standard rate of 0 on the difference between the total value of the supply and the value of the supply before 01 June 2018.

Supplies made by the Government are generally treated as out of scope supplies. GST shall be levied and charged on the taxable supply of goods and services. The sale of goods is an out-of-scope supply and the supply is not subject to GST.

However the extent to which this may increase the price of goods remains to be seen and may be somewhat mitigated depending on the scope of tax exemptzero-rated goods. GST is also charged on the importation of goods and services. When the goods are subsequently removed from the FTZ by Company B GST may be chargeable.

Where an invoice is received after 01 June 2018 for services rendered prior to 01. This tax is not required for imported or exported services. Out of scope purchases.

The implementation of the goods and services tax gst on april 1 2015 and its abolishment three years later probably makes it one of the most if not the most controversial tax to be introduced in malaysias historythe gst was also highly politicised abolishing it was the numero uno promise of the pakatan harapan government in its election manifesto on. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. This section will explain to you the scope of GST in Malaysia.

Other Related Guides 2.

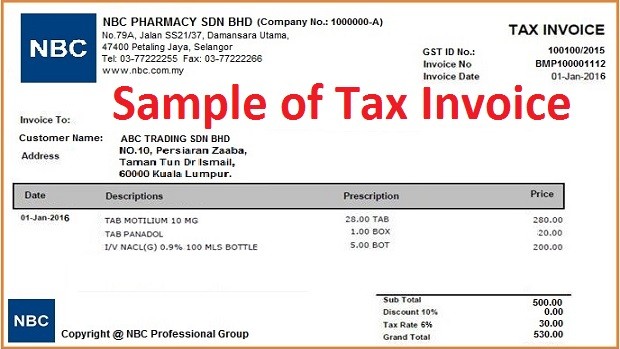

What Are Goods And Services In Gst Goods Services Tax Gst Malaysia Nbc Group

Goods And Services Tax Gst In Singapore What Is It

Goods And Services Tax Gst In Singapore What Is It

Goods And Services Tax Gst In Singapore What Is It

Cbic Clarifies The Scope Of Intermediary Under Gst Enterslice

Gst For Smes To Register Or Not

Gst News Archives Goods Services Tax Gst Malaysia Nbc Group

Debate Report Regarding Sst Vs Gst Mpu33013 Malaysian Economy Utar Thinkswap

Gst List Of Zero Rated Supply Exempted Supply And Relief

Gst News Archives Goods Services Tax Gst Malaysia Nbc Group

Classification Of Supply Under Gst Accoxi

Gst List Of Zero Rated Supply Exempted Supply And Relief

Goods And Services Tax Gst In Singapore What Is It